Dividends are on the rise when

investors have fewer reasons to buy the stocks that pay them out.

More than a fifth of the

companies in the S&P 500 have boosted their dividends to shareholders so

far this year, while none have slashed their payouts, a first since 2011,

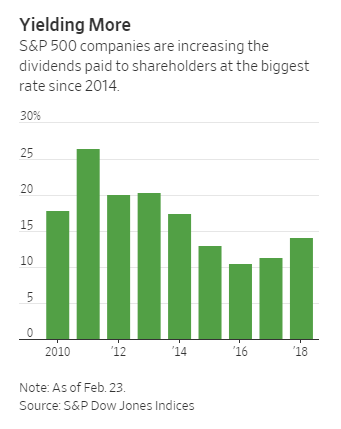

according to S&P Dow Jones Indices. The increases are getting bigger too,

with companies on average raising their payouts by 14%, the biggest jump since

2014.

The dividend boosts—from an array

of companies including cable-giant Comcast Corp. ,

asset-management firm T. Rowe Price

Group and consumer-products company Kimberly-Clark Corp.—come as firms

report some

of their best earnings and sales in years, offering further support

for the nearly nine-year bull run in stocks.

Companies also have

been spurred to put hundreds of billions of dollars to work since the

tax overhaul law was enacted last year. February is typically the busiest month

for dividends as companies roll out their annual results and reward

shareholders ahead of their annual meetings. Historically, more than half of

the companies in the S&P 500 increase their dividends each year, and in

recent years, 60% or more of the index boosted their payouts, according to

S&P Dow Jones Indices.

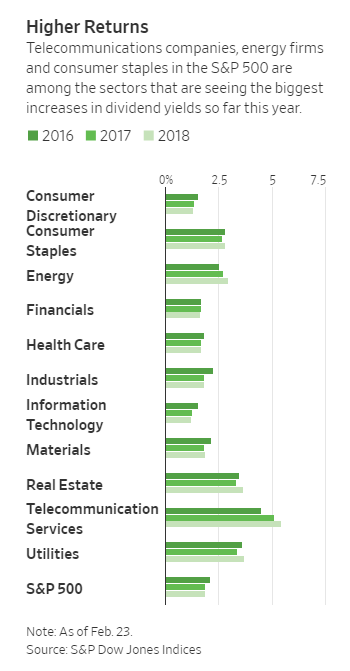

Eight of the 11 major S&P 500

sectors are generating a higher dividend yield than last year, including energy

firms, consumer staples and health-care companies. Energy firms are seeing some

of the biggest dividend increases, with three companies— Anadarko Petroleum Corp. , Pioneer Natural Resources Co. and

Cimarex Energy—at least doubling their payouts this month.

In total, four companies in the

S&P 500 have at least doubled their dividends to shareholders this year,

matching the number for all of last year.

“It’s a function of the strong

economic backdrop coupled with the changes to the tax code,” said Mike Allison,

a portfolio manager with Eaton Vance . “A

healthy earnings backdrop and lack of anything better to do with capital other

than to return it to shareholders is something we like.”

But rising bond yields

threaten to diminish the allure of those stocks. Yields flirted with

multiyear highs this month, before pulling back slightly, amid signs that

long-dormant inflation

could be picking up enough to force the Federal Reserve to speed up

its pace of interest-rate hikes. That coincides with concerns that larger

budget deficits could increase the supply of government bonds in the market.

Those jitters sent stocks

sputtering earlier this month, pushing the Dow Jones Industrial Average and the

S&P 500 into

correction territory for the first time in two years. Although stocks

have regained some of their footing since then, higher volatility has kept

investors on edge. Following the pullback, the S&P 500 and the Dow are both

up 4% so far this year.

That makes bonds relatively more

attractive than they have been in years and threatens to displace

high-dividend stocks as the investment of choice for those seeking

yield.

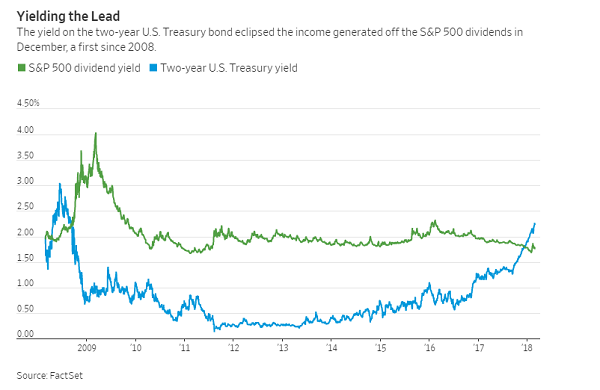

The yield on the two-year U.S.

Treasury note surpassed the income investors could earn from dividends on the

S&P 500 in December, a first since the throes of the financial crisis in

September 2008. The spread between the two has continued to widen this year

with two-year bonds touching a high of 2.27% in February, nearly half a

percentage point greater than what the S&P 500 had been yielding.

But bond yields are still

relatively low and would have to move higher, with the benchmark 10-year U.S.

Treasury yield at least above 3%, to spark a bigger rotation out of equities

and into bonds, money managers say.

“Now that rates are higher, bonds

are more attractive enough to start some sort of shift,” said Jay Jacobs,

director of research at exchange-traded-funds provider Global XManagement Co.

“But the case for keeping equity payers in a portfolio is still very strong.”

Utilities and real-estate

companies in the S&P 500 tend to pay bigger dividends relative to their

share price than most other sectors and continue to offer better yields than

short-term bonds, as well as the 10-year Treasury note, which settled Monday at

2.862%.

Still, utilities and real-estate

stocks have been struggling since November as bond yields ticked higher. And

the stock-market pullback has exacerbated their lackluster performance, putting

utility and real-estate stocks among the S&P 500’s worst performers of the

year. About $2.1 billion has flowed out of dividend-heavy exchange-traded funds

over the five weeks ended Feb. 14, up from the $648.6 million in redemptions

for the prior five-week period, according to data provider EPFR Global.

The pace of those redemptions

appeared to be slowing, however. About $118 million flowed into those funds in

the most recent week, according to EPFR’s data.

“Now that rates are going higher,

it’s going to make bonds a lot more attractive,” said Mr. Jacobs. “What’s

probably at the most risk right now is those lower yielding stocks.”

Click

here for the original article from Wall

Street Journal.