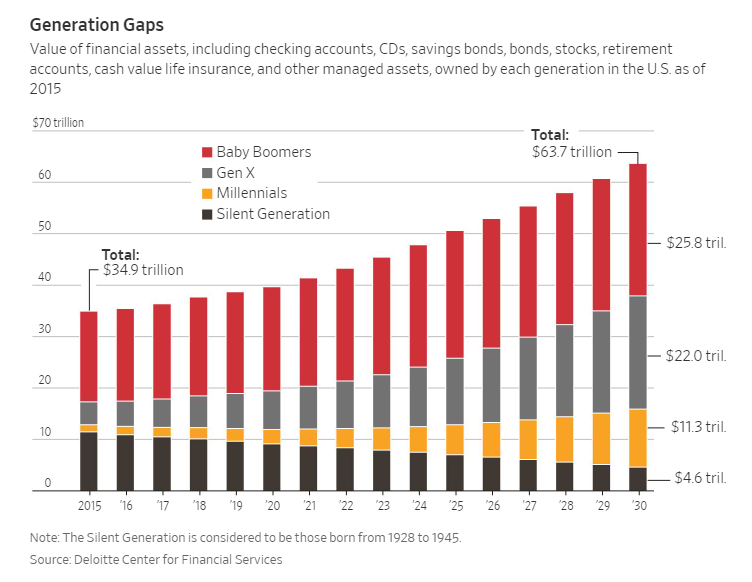

Millennials are expected to have

more than $11 trillion in financial assets in the next 12 years. Who will help

them manage that money as they get older?

The battle between fintech

startups and traditional wealth-management firms promises to be a fierce one.

Many younger investors are loyal to the fintech startups, which are trying to

expand their offerings. The traditional firms, meanwhile, have polished their

once-dreary websites and rolled out low-cost options in a bid to attract

millennials.

“The problem that some of the

fintechs will face is that while they were with you when you didn’t have much

money, they gave you a great experience and didn’t make you feel like you were

less than a full-fledged investor, does that loyalty carry over when your

financial needs become more complex?” says Raja Bose, a partner at consulting

firm Genpact .

But established wealth managers

should take little comfort in whatever growing pains fintech firms might

encounter. In many ways, this is the newer companies’ race to lose, some

observers say.

Fintechs’ advantages

Fintechs, which often started

with one product, are now offering many. For instance, Acorns, a platform that

helps its 3.7 million users save by investing spare change into exchange-traded

funds, has in the past year launched an individual retirement account product

called Acorns Later, as well as a debit card. It’s also exploring

impact-investing products, which are geared toward social and environmental

goals, an area thought to be popular among millennials.

“You have a lifelong relationship” with

someone if you can help them do something they thought was otherwise

impossible, like saving money, says Noah Kerner, chief executive of Acorns.

Fund giant BlackRock BLK +0.12% recently invested $50 million in Acorns to help

it expand further.

Betterment, a robo-advisory

pioneer, is also branching out. Last year it launched a premium product for

those who have managed to accumulate a significant amount of money—at least

$100,000 to keep in a Betterment account. It includes unlimited access to human

advisers and carries an annual fee of 0.4% of the account balance. That

compares to its digital service, which has no minimum and a 0.25% fee.

“The industry’s case is: ‘Oh

yeah, when [millennials] grow up and have money they’ll come running’ ” to the

old-line wealth-management giants, says Matt Harris, a managing director at

Bain Capital Ventures. Bain was an early investor in Acorns. “I don’t think

that’s a safe bet—not even remotely.”

One advantage the challengers

have is that they are digital-first by their nature. That positions them well

with millennials, who tend to have either grown up with a digital mind-set or

become more digitally dependent than many older investors. Millennial investors

“are far more likely to feel that some of the most cutting-edge technology

tools are basic requirements of a service offering, rather than a

‘nice-to-have,’ ” according to a 2017 report on millennials and money by

Accenture .

Fighting back

But the old guard are hardly

pushovers. A few years ago, the conversation about incumbents vs. challengers

was about apps and interfaces. Fintechs had slicker offerings. But Genpact’s

Mr. Bose says incumbents have largely closed that gap.

For instance, Merrill Lynch and

Morgan Stanley MS +0.11% have launched their own robo advisers with interfaces

they believe rival those of the newcomers. They are, however, eyeing customers

who already have a few thousand dollars to invest. Merrill Lynch’s Merrill Edge

Guided Investing and Morgan Stanley’s Access Investing both have a $5,000

minimum. Betterment has no minimum on its digital account and Wealthfront’s is

$500.

Merrill and Morgan Stanley also

charge slightly more in fees, which they say is justified by the combination of

human and digital advice available to their robo clients. “As people age, their

lives get more complex—there are trust and tax and estate issues, mortgages and

inheritance,” says Naureen Hassan, chief digital officer at Morgan Stanley

Wealth Management. “That’s where we see people wanting the help of a financial

adviser to help them talk through decisions and make decisions in a

collaborative way.”

Millennial customers have “an

appreciation for both the high tech and the high touch,” says David Poole, head

of advisory, client services and digital capabilities for Merrill Edge, the

online side of Bank of America Merrill Lynch’s brokerage business.

Some investors—young and

old—prefer to act as their own financial adviser. These market junkies have

long used discount brokers like TD Ameritrade or Charles Schwab to save on

commissions. Millennials often play the market with the app Robinhood, which

doesn’t charge any commissions. Now JPMorgan Chase plans to launch an app that

will offer 100 free stock trades to account holders at its retail bank in the

first year. (Merrill Lynch also offers Bank of America account holders free

trades on Merrill Edge, if they meet balance requirements.)

Joining forces

One way incumbents and newcomers

could proceed is by joining forces, says Mr. Bose. Goldman Sachs approach could

provide a road map. Although the firm has a long history of serving the

wealthy, Marcus by Goldman Sachs, the company’s online consumer bank, is eyeing

the same types of customers as the fintechs. Its consumer-loan business, which

people often use to consolidate credit-card debt, has no origination fees and

low rates, and lets users customize things like the payment date. The minimum

size for its high-yielding savings accounts is $1.

Earlier this year Marcus bought

Clarity Money, an app that lets consumers view all of their financial data in

one place, keep better tabs on their spending and see tailored offers for

various financial products. One of Clarity’s partners is Acorns.

The partnership with Acorns was a

draw for Marcus, says Omer Ismail, chief commercial officer at Marcus.

Marcus doesn’t currently offer

investing tools, but the company is exploring that possibility, Mr. Ismail

says. Goldman is leaning on the company’s legacy, Mr. Ismail says, but it is

also looking to build trust the way fintechs did it—by addressing specific

challenges people face in figuring out their finances.

Click

here for the original article from Wall

Street Journal.