If you participate in a 401(k) or similar retirement plan through your job, you likely direct where the money you contribute is invested. Making good investment decisions can have a real impact on how much your retirement savings grow.

While there are a number of factors to consider in making sound investment decisions, start with the information provided by your plan. Your plan administrator should provide you with key information about certain investment options offered by the plan every year. This information is provided in a format that allows you to compare the investment options.

To help you use the investment-related information provided by your plan, this publication describes some of the key information you will receive from your plan and provides tips on using this information in evaluating your investment choices in your plan.

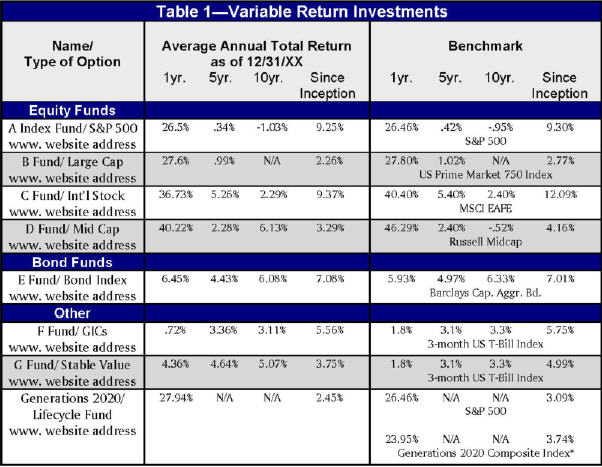

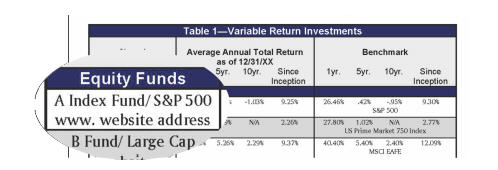

Performance data – The rate of return for many investments, like mutual funds, changes over time; some years returns will go up, and in other years, they will go down. The information from your plan includes the average annual total returns for each of the investments offered by the plan with returns that vary over time. The returns are provided for different time periods - the last year, the last five years, the last 10 years, or over the life of the investment, if shorter.

For example, if you are considering investing your plan contributions in an equity or stock fund, your plan may offer a number of such options. As you can see from the model chart, there are four equity funds available. In comparing the middle column – the average annual total returns – you can see that the returns for all of the investments varied over time. Remember that past performance is not a guarantee of future performance – it merely is a helpful factor to include in your decision making because it provides information on the volatility (or stability) of the fund. Note that shorter time periods may reflect the impact of a specific event whereas longer term performance may include periods of ups and downs.

Your plan may offer a number of types of investments with returns that vary such as equity or stock funds, bond funds, etc. And there may be options for each type of fund. Compare the returns for the same type of fund and between the different types of funds. Keep in mind that there are other factors to consider in your investment decision – such as the fund’s investment objectives, the risk involved in the fund’s investments and the fees and expenses charged by the fund to investors. The information from the plan will help you to learn more about these factors too.

The comparison information from your plan also will cover other types of investments offered under the plan such as those with a stated or fixed rate of return, employer securities, and annuities.

Benchmarks – After comparing the performance of the investment options in your plan to each other, you should evaluate them against an appropriate broad-based securities market index. This index is referred to as a benchmark. There are different benchmarks for different types of investments. The benchmark is named in the information from your plan for the options with returns that vary. The benchmark information provides returns for the same time periods provided for the specific investment options offered under your plan. This gives you an idea of how your plan’s investment option is performing when evaluated against the benchmark. Keep in mind that benchmarks do not include fees and expenses.

For example, looking at the equity fund options included in the model chart, the return of A Index Fund can be compared with the S&P 500 Index. This comparison shows that the A Fund had higher returns than the benchmark over the last year but lower returns than the benchmark over the last 5 years.

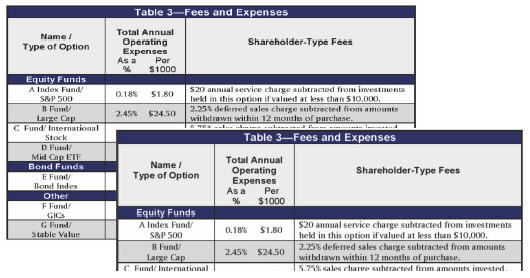

Fees and expenses – Another important feature in the information from your plan is a comparison of the fees and expenses of each investment option. Fees and expenses affect your investment returns and reduce the growth in your 401(k) plan account.

The information from your plan includes two types of fees and expenses: total annual operating expenses (TAOE) and shareholder-type fees.

Total annual operating expenses are the costs of running the fund, including management fees and distribution fees that reduce the rate of return. These expenses are expressed both as a percentage of the fund’s assets and as a dollar amount per $1,000 invested. For example, for Fund B - the operating expenses are 2.45 percent of the fund’s assets or $24.50 for every $1,000 invested in that option. That compares to Fund A which has operating expenses of .18 percent or $1.80 for every $1,000 invested.

Shareholder-type fees ordinarily are charged directly to your plan account. They include service charges and sales charges for purchasing or selling shares of the fund. For example, in addition to the operating expenses charged to Fund B, there is a 2.25 percent deferred sales charge that is subtracted from amounts withdrawn from the investment in the first year after purchasing the fund shares.

Website addresses – For each investment option, a website address where you can find additional information is provided. This information includes the investment’s objectives and goals, the principal strategies (including a general description of the types of assets held) and risks, and the portfolio turnover rate (indicates the frequency of the fund’s buying and selling of its investments which may affect the fund’s trading costs). If you do not have access to the Internet, the name and number of a plan official you can contact for a paper copy of the information found on the websites is provided in the information from the plan.

Glossary – To help you understand the investment options offered by your plan, a glossary of investment and financial terms is provided as part of the investment-related information from your plan. The glossary may be included in the information on the comparative chart from your plan or on a website.

Tips on Using the New Fee and Investment Information

• Review all of the information about each investment option before you invest including the additional information on the websites provided – it is an important part of your investment decisions.

• Consider your retirement goals and how long you have to reach them. This will impact your investment mix and the level of risk you want.

• Compare the performance data to the benchmark for the same time periods to see how the investment options have performed compared to the market and over time. The past year performance, while the most recent, may reflect the impact of a specific event. Longer term performance may include periods of ups and downs.

• Compare all services received with the total fees and expenses paid out of your account.

• Don’t consider fees in a vacuum – they are one part of a bigger picture including investment risk and returns and the extent and quality of the services provided.

• Remember the importance of diversifying your investments. By investing in different types of investments, you are more likely to reduce risk and improve return.

• Never invest in anything you don’t understand or don’t feel comfortable with. Use the information on the website addresses provided and the glossary to help. If you have any questions, contact your plan administrator.

• When you receive your periodic fee and investment information from your plan, review your investments, your retirement goals, and the investment options offered by your plan to see if you want to make any changes.

For more information about retirement plan fees and expenses, please see the Employee Benefits Security Administration’s (EBSA) publication A Look at 401(k) Plan Fees at www.dol.gov/ebsa.