The best-laid retirement plans

take into account investment-return assumptions and withdrawal rates. They

should also include planning for unexpectedly early departures from the

workforce.

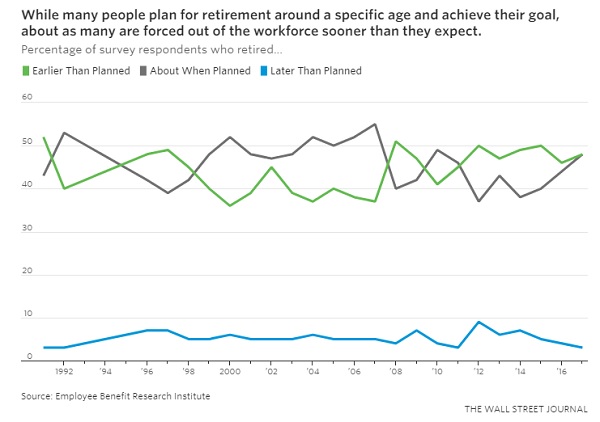

While an increasing number of

Americans say they want to remain on the job after age 65, between 37% and 52%

of retirees polled annually since 1991 by the Employee Benefit Research

Institute say they left work before they had intended—often due to a health

issue or job loss.

As a result, individuals should

prepare for the possibility of an early retirement as part of their overall

planning. Steps to take include amassing three to six months’ pay in an

emergency fund and securing disability insurance, says Anna Rappaport, chairwoman

of the Society of Actuaries’ Committee on Post-Retirement Needs and Risks.

Those facing an imminent

departure also should focus on decisions about health insurance and any

severance pay or disability insurance they qualify for. Here’s a guide to those

decisions.

Health Insurance

If you leave your job when you

are 65 or older and don’t have another job with health insurance lined up, the

decision about how to replace your health insurance is simple: Before your

employer-sponsored coverage lapses, contact Social Security and sign up for

either original fee-for-service Medicare or a Medicare Advantage plan, which is

a health-maintenance or preferred-provider organization that contracts with

Medicare.

Those under 65 must look

elsewhere for coverage. Possibilities include joining a spouse’s plan, buying

coverage under the Affordable Care Act, or remaining on a former employer’s

plan under Cobra, a federal law that requires companies with 20 or more

employees to permit former workers to stay enrolled in the health plan,

typically for up to 18 months.

Cobra can be expensive. That’s

because while many employers subsidize workers’ premiums while they are

employed, they often require those on Cobra to pay the entire cost plus a 2%

annual administrative fee, says Juliette Cubanski, associate director of the

Kaiser Family Foundation’s Program on Medicare Policy.

With an ACA policy, individuals

with incomes of up to $47,520 and couples earning up to $64,080 may be eligible

for tax credits that cap their premiums on a benchmark plan—designed to cover

70% of medical expenses—at between 2% and 9.5% of income.

If you are using either Cobra or

an ACA policy, switch to Medicare once you turn 65, Ms. Cubanski says. If you

don’t make the move in the three months before or after your 65th birthday,

you‘ll have to wait until the beginning of the following year to sign up—and

your coverage won’t go into effect until July 1. For each year you wait to sign

up, you will pay an annual penalty of 10% of your premium under Medicare Part

B, which covers doctor visits, and about 12% of your Medicare Part D premium.

Severance

Companies frequently offer

severance to employees they lay off. One or two weeks of pay for every year of

employment up to a cap, such as 26 weeks, is typical, says Christopher

D’Angelo, an employment lawyer in New York at Michelman & Robinson LLP.

Some firms also include outplacement services or bonus pay for the portion of

the year an employee was on the payroll.

If you feel your employer is

pressuring you to quit, you may have some leverage to negotiate severance, says

Ms. Rappaport.

In contrast, those subject to a

mass layoff typically have little leverage to bargain unless they band together

or have “a strong legal claim,” says Mr. D’Angelo, citing someone who recently

filed a sexual-harassment claim.

Because companies pay severance

only after employees sign waivers releasing them from legal claims, an employer

might be willing to pay more severance to encourage someone with such a claim

to waive the right to pursue it.

Before accepting severance, have

an employment attorney review the agreement, says Ms. Rappaport. The Age

Discrimination in Employment Act gives those subject to layoffs involving more

than one employee up to 45 days to consider a severance offer—and confer with

an attorney—plus seven days after signing in which to revoke that decision.

Unless you have complex issues,

total costs for an employment attorney are likely to range from $1,000 to

$5,000, says Mr. D’Angelo.

Disability Insurance

If you become disabled, you may

qualify for benefits under an insurance policy or a government program.

Many employers offer free

short-term disability coverage for up to 90 days as part of a benefits package.

Some also provide long-term coverage or allow employees to buy it at a

discounted rate to help plan for the possibility of early retirement due to disability.

(Individuals also can buy coverage directly from insurance companies.)

Long-term disability policies

typically pay 50% to 60% of a disabled employee’s salary, says Mike Stein,

assistant vice president at Allsup, a Belleville, Ill., company that represents

people filing disability claims.

To collect, you have to meet your

policy’s definition of being disabled. “It’s not uncommon to see policies that

say, ‘We will pay you if you are unable to do your former job for the first two

years and after that, we will continue to pay you only if you cannot do any

work,’” says Mr. Stein.

If you paid Social Security taxes

for 20 of the past 40 quarters, you may qualify for Social Security Disability

Insurance if your disability is expected to last at least a year or result in

death. (Supplemental Security Income is a separate program for low-income

people with disabilities.)

If you qualify for both SSDI and

private disability insurance, file for both, Mr. Stein says. Generally, your

insurer will reduce your policy’s benefits by the amount of your SSDI, says Mr.

Stein.

SSDI often adjusts its payments

annually for inflation and allows recipients to file for Medicare after two

years, among other benefits.

Click

here for the original article from Wall

Street Journal.