Planning for retirement is a priority for most physicians,

but with hefty student loan debt, home mortgages and car loan payments, about

one in five say they are behind schedule. For many, the pandemic has added a

new level of uncertainty, as investment and income-related losses mount.

At the 2020 virtual Clinical Congress of the American

College of Surgeons, Edward M. Barksdale Jr., MD, FACS, FAAP, described his

family’s personal financial journey over the past three decades, offering some

perspective and a road map for surgeons.

Before diving into specifics, Dr. Barksdale stressed the

importance of understanding and staying true to who you are and what you value.

“My identity and values were carved by my childhood and

early adult experiences,” said Dr. Barksdale, the surgeon-in-chief at

University Hospitals Rainbow Babies & Children’s Hospital, and a professor

of surgery and pediatrics at Case Western Reserve University School of

Medicine, in Cleveland.

At a young age, he saw how financially savvy and frugal his

parents were. His father, a mailman, and his mother, a sock seamstress, grew up

during the Great Depression, which shaped a careful approach to saving.

“I learned the importance of living below your means and

planning for rainy days,” Dr. Barksdale said. “But I also had a different

philosophy than my parents. It wasn’t just save, save, save. I wanted to enjoy

life without being wasteful.”

In 1994, after 10 years of medical training and accruing

$50,000 in student loan debt, Dr. Barksdale embarked on his career in pediatric

surgery. In that first year, Dr. Barksdale and his wife established their

priorities—buying a home and starting a family—and created a budget and savings

strategy to support those aims.

“After a year, we realized we didn’t have the time or

insights to meet our goals, so we decided to hire a financial planner, someone

who had experience working with other academic physicians, someone who we felt

we could trust,” Dr. Barksdale said.

Trust is key for Dr. Barksdale, more important than getting

the highest financial return.

“I’m a relationship person, and I wanted to find someone who

would get to know me and understand my risk tolerance,” he said.

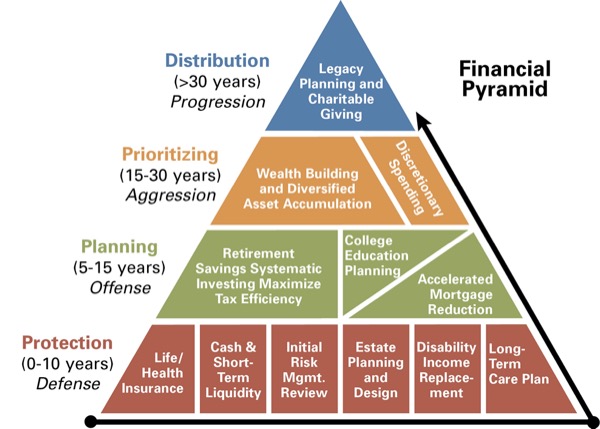

To get started, the couple’s financial advisor presented a

four-tier financial pyramid (Figure 1). The first rung—the protection

phase—allowed the Barksdales to establish a protective shell, a foundation for

saving and investing over the next decade. This meant getting life and health

insurance, purchasing a home and putting 10% of their income, outside of a

401(k), into savings.

About five years in, the next stage—the planning phase—began.

The aim of this more proactive period is to accelerate retirement savings,

mortgage payments, college education funds for their growing family and,

lastly, allow them to plan for emergencies.

Having this infrastructure helped Dr. Barksdale and his wife

weather several unexpected expenses in 1998: a major electrical house fire, for

which they were underinsured, and a decision to move their son from public to

private school after he was diagnosed with a reading-based learning disability.

Although the family adjusted by making changes to their

monthly budget, these surprises highlighted the importance of building a

financial foundation that could bend, but would not break, under pressure.

Handling personal surprises and fluctuations in the market over 25 years has

left Dr. Barksdale rather unfazed by the current crisis.

“I don’t get too shaken by any one downswing because the

market will eventually recover,” Dr. Barksdale said. “The key is to reassess

your financial plan and remain flexible.”

Dr. Barksdale is currently in the third tier of the

financial planning pyramid—prioritizing or wealth building. In this highly

aggressive phase, the goal is to rapidly grow and diversify investments,

maximize contributions and cut discretionary spending in preparation for

retirement.

Personalizing a Financial Strategy

Key questions: What can my money do for me? What are my

aspirations in 10, 20 and 30 years?

For Edward M. Barksdale Jr., MD, FACS, FAAP, those

priorities come down to family, home, education and planning for retirement.

But priorities may be different for others, which is why Dr.

Barksdale advises young surgeons to reflect on their personal goals “over a

steering wheel, dinner table or the pillow,” and “find a financial adviser you

can grow with over time.”

“How we manage our finances isn’t just about how much money

we have; it’s also about how much life we have gained in the process,” he said.

Following the Road Map (Financial Pyramid)

Protection (zero to 10 years)

- Build a strong foundation by investing in

insurance

- Establish a budget and cash flow

- Develop a savings strategy: 10% of income

Planning (five to 15 years)

- Boost retirement savings and investments

- Save for college education

- Accelerate mortgage payments

- Plan for emergencies

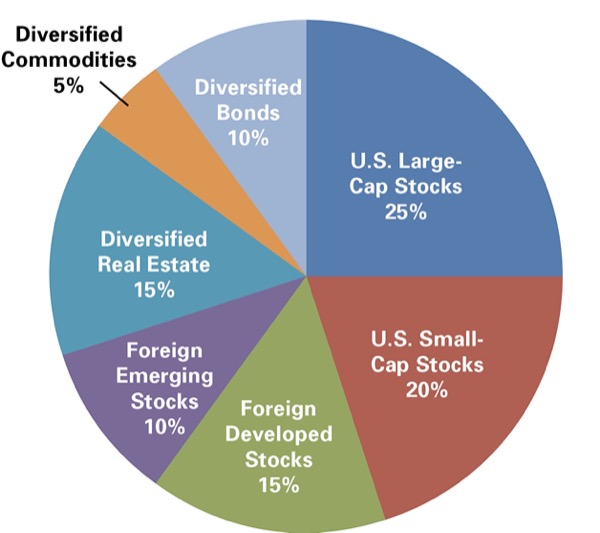

Prioritization (15-30 years) (Figure 2)

- Build wealth and diversify investments

- Reduce discretionary spending

Distribution/Retirement (>30 years)

- Consider charitable contributions and family

legacy

- Make plans for the estate

- Enjoy retirement!

Although retirement, the final phase, is still almost 10

years away, Dr. Barksdale is already thinking about the legacy he wants to

leave behind. In the last few years, he and his wife gathered their four

children for a family meeting after the Christmas holiday to discuss the family

assets and how to shift from the concept of financial success to one of social

significance.

One cause in particular speaks to Dr. Barksdale. He and his

wife support women and children who have been abused and neglected.

“In my work, I see fragile children who suffer from living

with fragmented families and women who lack security,” he told General Surgery

News, recalling a 2-year-old and 3-year-old who were brought to the hospital

with gunshot wounds on the previous night. “Some of these children will never

get stronger while living in broken places.”

Dr. Barksdale supports shelters for women and children, and

in 2019, started the Antifragility Initiative—a hospital-based violence

intervention program for children who have experienced severe interpersonal

violence, such as gunshot or stab wounds. Since launching the program, more

than 80 teenagers have been connected to therapy, mentorship or other services.

For Dr. Barksdale, the pandemic has brought the relationship

between his financial goals and life priorities into sharper focus.

“The pandemic has helped me recognize the importance of the

intangible,” he said. “Tangibles are money; the intangibles are mental health

and the love of my family. Money is a tool but it’s not the end goal.”

Click here for the

original article.