Congress is considering raising the corporate income tax

rate from 21 percent to 28 percent. Many assume that only big businesses will

pay this higher rate. That couldn’t be farther from the truth. In fact, over a

million small businesses—those “Mom-and-Pop” retailers, small manufacturers,

and professional services firms that often suffered the worst during the

pandemic—would also see their tax bills increase significantly. In turn, this

would have a negative impact on small businesses’ investment and growth plans

and, most critically, hiring and job creation.

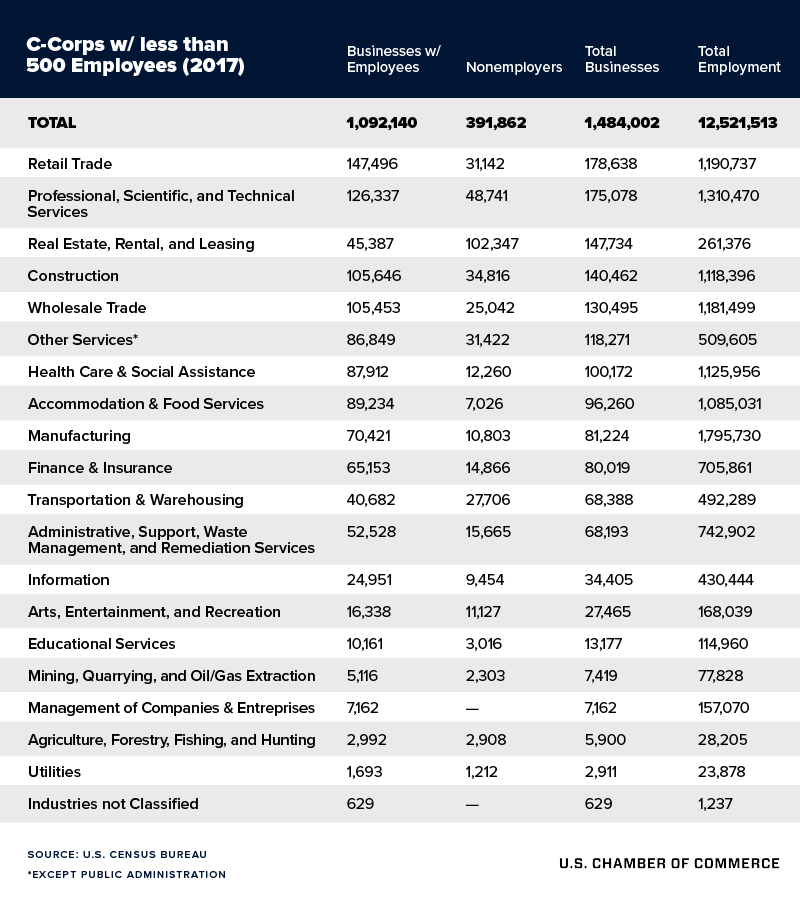

There are 1.4 million small businesses (those with 500

employees or less) officially organized as C-Corporations, which means they

would pay this higher rate. These small businesses employ almost 13 million

American workers across various sectors.

Hardest hit would be the sort of skilled jobs that

politicians love to praise, but often in practice, do too little to support.

Manufacturing small business C-Corps employ the most workers out of the group

(1.8 million workers). Professional, scientific, and technical services are

next (employing 1.3 million), followed by retail (employing 1.2 million).

Most C-Corporations are small businesses and many are very

small: over 84% of C-corps have fewer than 20 employees. Small business owner,

Michael Canty, is the President of Ohio-based Alloy Precision Technologies, a

manufacturing company that employs roughly 85 people and is structured as a

C-Corp under the federal tax code. His business would be hit hard by the

proposed increase under Biden’s tax plan. Canty warned that the proposed tax

increase would make companies like his less competitive in the global marketplace.

"We have already started a hiring freeze. Between the

tax increase and what we see as a tough regulatory environment, we have to

prepare," Canty said.

Furthermore, small businesses organized as C-Corps are

spread across all industries. Retail trade (179,000) has the most businesses.

This is followed by professional, scientific, and technical services firms

(175,000); real estate, rental and leasing (148,000); and construction

companies (140,000).

Here’s how C-Corporations breakdown by small business

sector:

The Tax Cuts and Jobs Act of 2017 lowered the corporate rate

from 35 percent to its current 21 percent level. It helped spur growth and

investment by these 1.4 million C-corporation small businesses—allowing them to

grow when the time was right and to save up and weather the storm when the

pandemic struck.

Many of these small businesses are just now beginning to

return to normalcy: According to the latest MetLife & U.S. Chamber of

Commerce Small Business Index, 59% of small businesses believe it will take

more than six months to return to normal. Suddenly—and substantially—raising

their taxes is one sure way to stop the recovery’s momentum dead in its tracks.

This would be the highest corporate tax rate in the

industrialized world and would put U.S. businesses (large AND small) at a

severe competitive disadvantage with other technologically-advanced and savvy

counterparts across the globe. Higher rates on over a million small businesses

would suppress wage growth and job creation for American workers—at a time when

one of the few things we can all agree on is the need to strengthen the middle

class and create more higher-paying jobs here at home.

The strong economic growth and sharp wage increases for the

lowest-earning workers prior to the pandemic were proof the lower tax rate was

working as envisioned. Small businesses were a key contributor to this growth.

Raising the corporate tax rate would undo the progress made and threaten the

strong foundations of this recovery. Let’s keep corporate tax rates where they

are, so America’s small businesses can continue to prosper and create the

growth and jobs this country needs to keep this recovery going.

Click here for the

original article.