Americans across generations face a vortex of challenges

that are hindering their ability to save, leaving many with less than 50% of

income replacement in retirement, according to an annual survey by Goldman

Sachs Asset Management.

In fact, findings from the firm’s Retirement Survey &

Insights Report 2022 show that all generations of Americans have been

significantly impacted by competing financial priorities and life events that

have derailed the ability of many to save for retirement.

The survey—which seeks to learn directly from plan

participants about their experience preparing for, transitioning to, and

managing their finances in retirement—finds that this financial vortex of

challenges includes, but is not limited to, credit card debt, paying existing

loans, saving for college, caring for and financially supporting family

members, time out of the workforce, financial hardship and too many monthly

expenses.

As a result, 53% of working Baby Boomers and 51% of Gen X

respondents said they are behind in their retirement savings. Moreover, only

11% of working Baby Boomers and 12% of GenX are “very confident” in meeting

their retirement goals. Another 40% of working Baby Boomers and 32% of Gen X

respondents are just “somewhat confident,” while 30% of working Baby Boomers

and 40% of Gen X expressed concerns about meeting their goals.

Perhaps because they have a longer timeframe before planning

to retire, younger generations have brighter outlooks. Just 34% of Millennials

and 27% of Gen Z respondents report being behind schedule in their retirement

savings. Additionally, 31% of Millennials and 31% of Gen Z are “very confident”

they will meet their retirement goals, while just 19% of Millennials and 12% of

Gen X expressed concerns. Meanwhile, nearly 4 in 10 (39%) Millennials and 47%

of Gen Z respondents increased retirement savings over last year, while 32% of

Baby Boomers and 33% of Gen X decreased theirs.

“The financial vortex is the new reality for retirement

savers today,” says Mike Moran, Senior Pension Strategist at Goldman Sachs

Asset Management. “Some challenges are common life events, such as buying a

home or starting a family, but market volatility and high inflation are beyond

individual control. It’s not a question of if, but when someone will be

impacted.”

Moran explains that knowing how to adapt to keep retirement

savings on course is key to navigating these challenges. “The longer an

investor remains off-track, the larger the adjustments may need to be to fully

course correct. But more likely, we believe some will retire with insufficient

savings and need to adjust their retirement lifestyle and expectations,

accordingly,” he observes.

Impact Statements

Among the reasons working respondents gave for falling

behind, 46% reported that a financial hardship caused them to stop saving for

retirement—some for three years or longer. In addition, 43% of working

respondents reported they needed to take time away from the workforce to

provide caregiving for a family member. When they did, 39% said it caused them

to use some of their retirement savings and 25% stopped saving for retirement.

Meanwhile, during the pandemic, 14% of working Baby Boomers,

25% of Gen X, 33% of Millennials and 32% of Gen Z respondents said they

withdrew money from their 401(k) plan without penalty to cover expenses. Over

half (58%) of working Baby Boomers said they would not pay back these funds

within three years, while most Gen X (65%), Millennials (81%), and Gen Z (72%)

respondents reported that they would repay their 401(k) accounts within that

time period.

To that end, 37% of working respondents expect the effects

of the pandemic to delay their retirement.

Competing Challenges

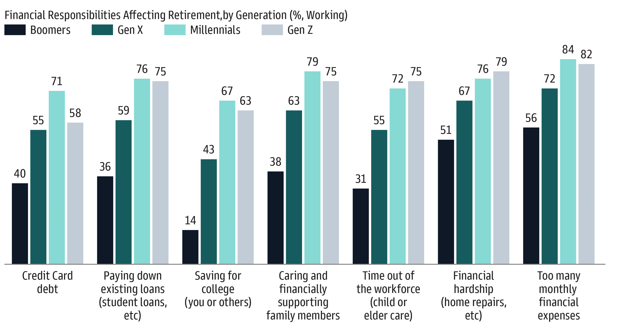

As generations age, their financial challenges inevitably

grow more complex and expensive, and their expectations around how long they

intend to work and how much they need to save for retirement may change. The

generational breakdown of the financial vortex challenges among working

respondents is:

Source: Goldman Sachs Asset Management

“Having dealt with life’s other financial challenges, many

retiring Baby Boomers are feeling the pinch of inadequate retirement savings,”

observes Chris Ceder, Senior Retirement Strategist at Goldman Sachs Asset

Management. “Gen X is now at the critical stage to navigate myriad short-term

goals, such as college savings, caregiving, and family life, all while keeping

their long-term savings on track.”

While many survey respondents report being behind schedule,

there is still time to adjust, adds Ceder. “However, the timeline is narrowing.

Millennials and Gen Z will be next up and currently report the highest impact

from competing priorities. Navigating these obstacles will be critical to avoid

falling behind on their savings,” he says.

Role of DC Plans and Advice

Almost all (95%) respondents consider financial

help—education, advice and counseling—important to successfully manage their

retirement savings. The top three challenges they seek advice for are:

generating income (34%);

understanding how long their savings will last (32%); and

understanding if savings are on track and, if not, how to

adjust (29%).

Employer-provided DC retirement plans are the top source of

education and advice for current workers (32%), followed by financial advisors

(31%) and family members (30%).

As for how they like to receive advice:

38% of workers said they prefer in person, phone or video

conference with a financial advisor;

34% were open to a combination of digital and human advice;

and

28% prefer digital or technology-based advice alone.

“Advancements in technology continue to enhance

employer-provided DC plans, giving them the power to personalize the retirement

planning experience for plan participants,” adds Ceder. “Everyone will have a

unique path to retirement and so it is increasingly important to meet them

where they are to help them reach their goal.”

The Goldman Sachs strategist further notes that they “expect

this trend to rapidly accelerate as the need for greater financial support and

market challenges—such as intense volatility, rising rates, and persistently

high inflation—elevate the risk of reaching retirement underprepared.”

The survey was conducted by Goldman Sachs Asset Management

and Qualtrics Experience Management among 1,566 U.S. participants between July

and August 2022. Participants included 967 working individuals across

generations (Baby Boomers, Generation X, Millennials and Generation Z); and 599

retired individuals aged 50-75.

Click here for the

original article.