After sitting on the sidelines

for a decade, millennials are buying homes en masse, promising to kick the

already strong housing market into higher gear.

Virtually all major builders are

migrating away from the luxury homes that dominated the early years of the

economic expansion and are focusing on lower price points to cater to this

burgeoning clientele.

“There’s an increasing confidence level in

that part of the market,” said Gregg Nelson, co-founder of California home

builder Trumark Cos. “The recovery is finally starting to take hold in a

broader way.”

The share of first-time buyers

fell to 32% in 2015, its lowest level in nearly three decades and down from a

historical average of around 40%, according to the National Association of

Realtors. That number climbed back up to 35% last year.

The housing recovery has been

divided, as the luxury market has soared in recent years while the more

affordable end of the market has struggled to make up for lost ground. Tough

lending standards, slow wage growth, growing student-debt obligations and a

newfound fear of ownership have combined to crimp demand among millennials in

particular. The return of the starter-home market means the housing bifurcation

is finally starting to narrow.

Demographers generally define

millennials as people born between roughly 1980 and 2000.

“They’re crawling out of their

parents’ basements, they’re forming households and they’re looking to buy,”

said Doug Bauer, chief executive of Tri Pointe Group Inc., which operates in

eight states.

The return of first-time buyers

allays fears that millennials would eschew homeownership and provides a long-awaited

infusion of new demand to the market. These new buyers could also be a boon to

the overall economy by driving builders to build more homes. But demand is

ramping up at a time when supply is already tight and price growth is

significantly outstripping wage gains.

Some 854,000 new-owner households

were formed during the first three months of the year, more than double the

365,000 new-renter households formed during the period, according to Census

Bureau data. It was the first time in a decade that more households chose to

own than rent compared with a year earlier, according to an analysis by

home-tracker Trulia.

In Orange County, Calif.,

Trumark’s Mr. Nelson said he has been selling entry-level homes at nearly

double the rate of his higher-end properties.

He is even gaining confidence to

build homes in more far-flung locations. The company is about to begin

construction on a 114-home project in the Inland Empire east of Los Angeles and

another development in Manteca, Calif., about 80 miles east of San Francisco.

Both areas were hard-hit during the housing crash and were among the slowest to

recover.

Outside Las Vegas, Tri Pointe has

introduced a new-home design that is specifically targeted to millennial

buyers, featuring indoor-outdoor patios and deck spaces, as well as a separate

downstairs bedroom-and-bathroom suite that could be rented out to a roommate.

Mr. Bauer said the homes, geared toward first-time buyers, have been selling

more rapidly than pricier homes.

Joey Liu, a 28-year-old

technology worker, purchased his first home in San Jose, Calif., earlier this

year. He said it is more expensive than renting but that he is getting to the

stage in life where it was time to buy.

“A lot of friends of mine bought

a home so I started thinking maybe it was time to buy a home and stop paying

rent,” said Mr. Liu, who settled on a three-bedroom townhouse for $690,000. He

plans to rent out a room to help with the expenses.

He had three house-warming

parties to celebrate his newfound status. “This is my first house, so it

definitely feels different,” he said.

In the first quarter of this

year, 31% of the speculative homes built by major builders were smaller than

2,250 square feet, according to Zelman & Associates. That is up from 27% a

year ago and 24% in the first quarter of 2015.

“Most builders really preferred

to stick straight down the fairway, right at the corner of Main and Main. They

were afraid to go back into the rough where they built a lot of homes in the

prior cycle,” said Alan Ratner, senior homebuilding analyst at Zelman.

Builders said that while they are

taking a chance by building homes farther out and starting construction before

they have a buyer in contract, it remains a far cry from the mid-2000s.

“One of the misconceptions is

that, here we go again, this is another 2005, 2006 where all these builders are

going to build hundreds of thousands of homes. We’re not going crazy,” said

Brent Anderson, vice president of investor relations at Arizona-based Meritage

Homes Corp. Mr. Anderson said that last year the company was building

four to five speculative homes per community and is now up to on average 6.4.

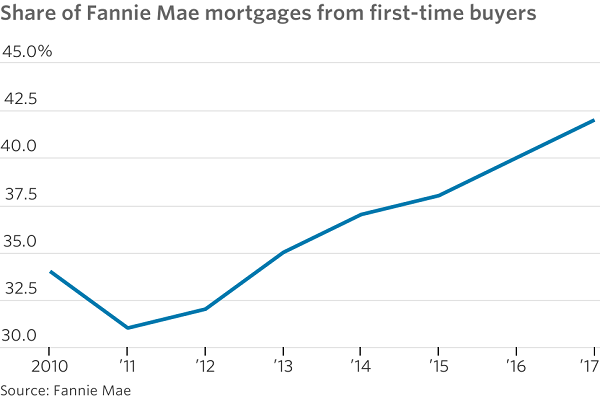

Some 42% of the mortgages

acquired by Fannie Mae so far this year were to first-time buyers, up from 31%

at the recent low in 2011 and 38% in 2015. Fannie, which acquires about

one-third of single-family mortgages, defines first-time buyers as anyone who

hasn’t owned a home in the past three years.

Building executives said one

challenge is that many people are buying first homes later in life, meaning

they have higher incomes and greater expectations molded by years of living in

luxury downtown rentals. They also appear wary of driving farther out to get

more space.

Sheryl Palmer, president and

chief executive of Arizona-based Taylor Morrison Home Corp., said to

cater to this demographic the company is building more three-story townhouses

or single-family homes on narrow lots. She said about one-third of the

company’s buyers this year are millennials, up from 22% last year.

Even Toll Brothers Inc., which

typically builds homes for the top end of the market, is venturing into lower

price points. In Houston, the company is building homes starting in the

mid-$300,000s range, while a typical Toll home in the area costs around

$850,000.

Click

here for the original article from the Wall

Street Journal.