Some steps to make sure you get

the best fiduciary advice if the government doesn’t help

When President Donald Trump

ordered a review of the Labor Department’s fiduciary rule for possible revision

or repeal, he put into doubt the government’s commitment to ensuring that all

retirement savers get advice that is in their best interest.

The Labor Department on Thursday

filed a formal notice seeking delay of the regulation beyond April 10, when it

was to go into effect. But you may still want a fiduciary level of oversight

for your individual retirement accounts and other investments. After all, a

fiduciary is required to act in clients’ best interest rather than under the

lower standard of suitability that has governed certain financial professionals

for decades.

Here’s what you can do to make

sure you are getting the most beneficial advice.

Understand the Sector

While most financial professionals

call themselves “advisers,” there are different types of advisers that are

regulated under different laws and held to different standards. As a result,

the degree to which any given professional advice giver must put a client’s

interests before his or her own varies.

“It remains extraordinarily

difficult for investors to figure out who is acting in their best interests and

who isn’t,” said Barbara Roper, director of investor protection at the advocacy

group Consumer Federation of America.

Advisers come in two basic

flavors: registered investment advisers, or RIAs, and brokers, who are also

known as registered representatives. RIAs are legally bound to serve as

fiduciaries. To minimize conflicts, they are typically paid a fee by clients

and avoid mutual funds, annuities and other products that offer them sales

incentives.

Brokers, on the other hand, are

allowed to recommend products that pay them the most in commissions and other

incentives as long as the product suits the client’s needs, a practice the

fiduciary rule would restrict.

To ascertain whether an adviser

is a fiduciary, simply ask, said Deena Katz, a professor of personal financial

planning at Texas Tech University. If you get an unclear response, ask the name

of the adviser’s regulator. The Securities and Exchange Commission and state

securities regulators oversee RIAs, while the Financial Industry Regulatory

Authority regulates brokers.

Check for Conflicts

Just because an adviser is a

fiduciary doesn’t mean he or she has no conflicts.

To ferret out conflicts, it is

important to ask the advisers how they are compensated and how they manage the

ethical dilemmas that arise as a result of their fee arrangement.

For example, most RIAs charge

clients a percentage of their account balance for financial planning and

investment management that typically amounts to 1% a year. Clients need to be

aware that such advisers stand to make more money by, say, recommending that

clients refrain from paying down mortgages or giving money to their children,

said Ms. Roper. Advisers are required to disclose such conflicts to the client

and should also present both a recommendation and alternatives.

More fiduciaries try to reduce

the potential for conflicts of interest by charging an hourly rate or flat

monthly or annual retainer fees. Advisers who charge such fees are “indifferent

as to whether the client puts money into their business, real estate, or

investments,” said Jacob Kuebler, an adviser in Champaign, Ill., who charges an

annual retainer fee.

But such fee arrangements create

conflicts of their own. For example, the hourly rate creates an incentive for

advisers to “work as slowly as possible,” said Sheryl Garrett, founder of

Garrett Planning Network, which has 250 members who charge an hourly fee for

financial planning. Ms. Garrett recommends asking for a written estimate of the

total cost and setting a deadline.

Also be aware that advisers at

brokerage firms may be “dually registered,” which allows them to serve as both

a broker and an RIA. To avoid situations in which a dually registered adviser

may work for you as a fiduciary when preparing a financial plan but as a broker

when recommending investments, ask whether he or she will serve as a fiduciary

for you at all times, said Ms. Katz.

Know What You Want

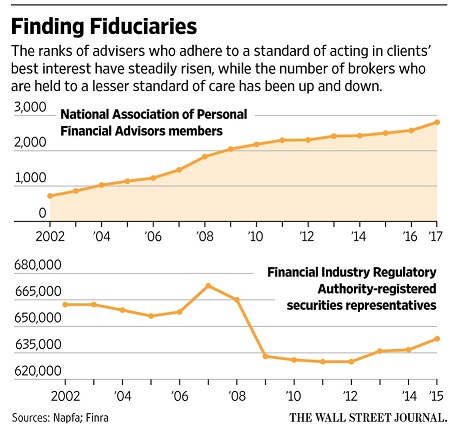

If you’re looking for a

fiduciary, the good news is the number of such advisers is increasing. And

while fiduciaries have historically focused on clients with six figures or more

to invest, more now work with clients of lesser means, using a variety of

arrangements.

Those who want a lot of

hand-holding should hire an adviser on a continuing basis. Traditionally, this

has meant paying an adviser 1% or so of your account balance annually for

financial planning and investment management, with investment-related fees on

top.

Most advisers who charge a

percentage of assets under management typically require a minimum portfolio

size, said Geoffrey Brown, chief executive of the National Association of

Personal Financial Advisors, which has more than 2,800 members, all of whom are

fiduciaries.

Those with smaller nest eggs, or

who prefer to use a different compensation arrangement, have an array of

choices.

The 355 advisers in the XY

Planning Network specialize in clients in generations X and Y, who typically

have incomes of $60,000 or more. The advisers charge a monthly subscription fee

that often ranges from $100 to $200 for financial-planning advice. The Alliance

of Comprehensive Planners has about 150 members who charge a flat annual

retainer fee for financial planning and tax-related advice based on a client’s

annual income or net wealth, said Mr. Kuebler, a former board member.

Those who want a more limited

engagement may benefit from hiring a planner on an hourly basis.

Garrett Planning Network’s

members charge an hourly fee for financial planning—$180 to $300 is typical.

Many clients pay a few thousand

dollars for a financial plan and then schedule periodic updates as needed, said

Ms. Garrett, who said clients can choose to pay the planner an asset-based fee

to manage their investments or simply manage the portfolio themselves.

The advantage, she added, is that

clients pay for no more than they need.

Before hiring any adviser, make

sure his or her expertise matches your needs. At a minimum, most advisers

provide financial planning and investment management. But some firms specialize

in a particular type of client, for example, technology executives with pre-IPO

stock or small-business owners with estate, tax and succession planning needs.

Check the adviser’s disciplinary

history on Form ADV filed with the SEC and look for professional credentials

that require extensive training and experience, such as the certified financial

planner designation.

With or without the fiduciary

rule, it is in your best interest to ensure you are getting a high standard of

care for your retirement assets.

Click

here for the original article from Wall

Street Journal.